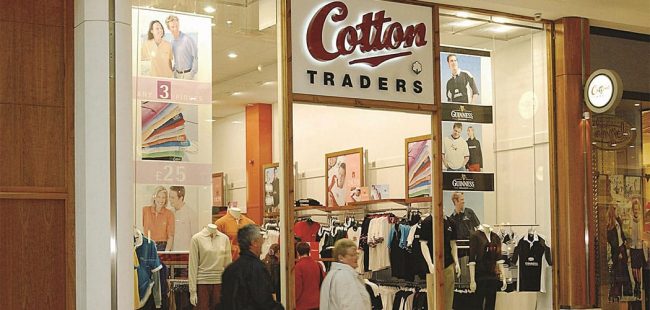

The facts: In June it emerged that casualwear

retailer/cataloguer Cotton Traders had suffered what it termed a

“security issue” in January. Fraudsters had hacked

into its website and gained access to encrypted credit-card data.

Multiple news sources reported that some 38,000 customer records

were compromised; Cotton Traders dismissed that figure as

“widely inaccurate”, though it has so far refused to

provide another figure.

Cotton Traders, which had a turnover in excess of £68

million last year, said that it called in industry experts to

resolve the problem as soon as it learned of the breach. The

company also said in a statement that following the breach it

upgraded the security of its website.

“Cotton Traders is a perfect example of why online

businesses need to secure their website and protect customers

online,” said a spokesperson for Verisign, whose Thawte SSL

certificate is displayed on the Cotton Traders site. SSL, or

Secure Sockets Layer, is a commonly used protocol that encrypts

sensitive data, making it more difficult for hackers to use the

information should they succeed in breaching the site. Cotton

Traders has said that the data were encrypted at the time of the

breach, and a screenshot of the home page from 13th August 2007,

as shown on the Internet Archive website (www.archive.org),

displays the Thawte “Secure Site” logo.

The buzz: Cotton Traders was the focus of much

analysis in the blogosphere once the news broke. Most

commentators felt the company should have done more to prevent

the breach-or at least should have been more honest about it.

Dave Whitelegg, who writes the IT Security Expert blog, commented

that Cotton Traders was using a lot of “smoke and

mirrors”, keeping the breach a secret from customers and

declining to confirm the extent of the damage. Another blogger,

from the Liquidmatrix Security Digest, expressed his surprise at

how long it took for Cotton Traders to disclose the breach.

By declining to provide additional information about the

incident, Cotton Traders may be hoping that the public will

forget about it. But the company’s silence could backfire, by

inflaming consumers, who will spread their opinions virally

throughout the internet. As Andy Barr of PR firm 10 Yetis,

himself a Cotton Traders customer, wrote on his company’s blog,

“I have yet to receive a communication from Cotton Traders,

which worries me slightly, and shows that they maybe have their

head buried in the sand a bit? Cotton Traders should be out

there, engaging with the media, explaining what happened and

reassuring its customers.”

What it means to you: “Fraudsters are

random,” said Ian Glanville, vice president of consulting

for secure-transaction specialist Logic Group, but what happened

at Cotton Traders was by no means an isolated incident.

“Attacks such as this happen all the time,” said

Glanville, who does not believe Cotton Traders was negligent.

“It’s how to prevent a breach that counts.”

Working to achieve compliance with the Payment Card Industry Data

Security Standard (PCI DSS) is vital, the experts agree. The

Logic Group estimates that only 15-20 per cent of retailers are

compliant but that the majority are working toward meeting the

standard.

Other advice includes storing as little data as possible and

encrypting whatever data you do keep; being sure you understand

the flow of data in your organisation; addressing application and

network vulnerability; and improving security awareness within

your company.

But although “putting all the security measures in place

makes a breach less likely,” Glanville said, “you

will never remove the possibility of attack.” As for the

Cotton Traders website, he described its upgraded security

measures as “sadly, a case of closing the stable door after

the horse has bolted”.

Share