Barclaycard Payments’ second SME Barometer has found that, despite UK businesses predicting poor short-term performance, and reporting a dip in sentiment compared to last quarter, there are early signs that they have begun the road to recovery.

The report found that business sentiment has dropped by 31 points this quarter, down to 79 points out of a possible 200, with any score below 100 indicating a negative sentiment. This is paired with low expectations for business growth, with revenue predicted to fall by 28 per cent in Q2 and contract by 5.1 per cent over the next 12 months.

More than four in five (82 per cent) SMEs say coronavirus has already had a negative impact on their business and nearly three quarters (73 per cent) forecast coronavirus to continue to have a significant negative impact for the next three months.

However, many businesses remain positive about the future. Only one in five (19 per cent) think the virus will still have a significant impact after 12 months, and just 8 per cent feel it will still have a significant negative impact in two years’ time, with 70 per cent expecting a slight or no noticeable impact.

There are also early signs of growth in the short term, with Barclaycard Payments data revealing that the number of SME clients actively taking payments, both online and offline, has increased by 24 per cent since the low point in early April, shortly after the start of lockdown.

Demonstrating a determination to succeed, almost two-thirds (64 per cent) of SMEs say they are planning to invest in their business over the next 12 months. Their top areas of focus will be marketing (26 per cent) and new equipment and technology (20 per cent).

Konrad Kelling, Head of Small Business Acquiring, Barclaycard Payments, said: “It’s encouraging to see small and medium-sized businesses starting to come online again as we emerge from lockdown. While we don’t expect an overnight recovery, the resilience and perseverance of small businesses gives us optimism as we look towards the next 12 to 24 months.

“It’s not surprising to see that small and medium-sized businesses feel the environment will continue to be challenging this quarter, with SMEs highlighting disruption to their supply chains, difficulty reaching customers and adapting to entirely new ways of working as key challenges. We understand why SMEs are worried – and we are working tirelessly to make it as easy as possible for small business owners to get the information and support they need.”

Business impact: size matters

Micro, small and medium-sized businesses are feeling the impacts of coronavirus differently. Micro businesses have been the hardest hit by the virus downturn, expecting revenue to drop by 30 per cent in Q2 compared to last quarter and reporting a sentiment score of 75, down 34 points from last quarter. Meanwhile, small businesses stand at a sentiment score of 88 and medium-sized businesses at 87.

Moreover, the way in which businesses have been affected also varies depending on size. Medium-sized businesses are most likely to say they’ve had to reduce staff hours or lay off staff (64 per cent), compared to a national average of 47 per cent. They were also most likely to report a drop in staff productivity – 41 per cent report this problem compared to a national average of just over a quarter (26 per cent). Small businesses were more likely to report disruptions to supply chains, at 47 per cent over a national average of 37 per cent.

Emma Jones, Founder of Enterprise Nation, says: “We’ve seen a 200 per cent increase in traffic to our website since the crisis began. Initially, businesses were searching for help to access financial support. Since then, we’ve seen a gentle shift as businesses start to look beyond the three-month horizon and have started to ask for advice on how to pivot, access their customers in new ways and increase their skills for when we can get back to business.

“We are also seeing evidence that they are using this time to plan and absorb advice that they may not otherwise have had the ability to do in normal circumstances. Despite low levels of short-term optimism, it’s also good to see that founders are expecting to see a more positive future over the next two years.”

Sector breakdown

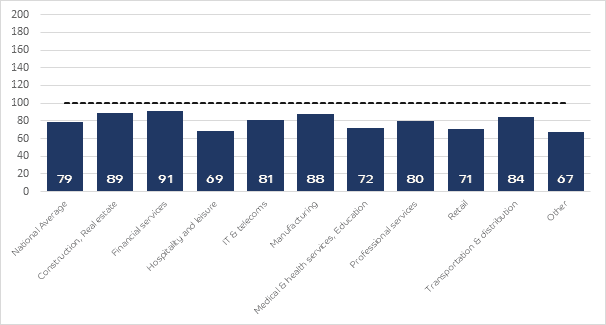

Graph of SME sentiment, broken down by sector*

For any SMEs unsure where to turn for support or how to adapt in these uncertain times, Barclaycard and Enterprise Nation provide the following advice:

1. Lean on your partners

If you need advice or guidance, and especially if you’re struggling financially, the first step should be to contact your bank or payments provider. Often the quickest and easiest way to do that is online, with many financial providers developing digital tools to help you get a response as quickly as possible. Also, consider joining a local business group. If lockdown has taught us anything, it’s how important your local network can be. Business groups are usually free to join and mean you can keep your spirits up with online meetings whilst getting some important intel and learning more about the business community in your area. The first step to getting help is by asking the right questions. Get in touch!

2. Get online

Since the start of lockdown, one in three medium-sized businesses (29 per cent) has increased their activity on social media, and a third (33 per cent) has increased focus on online sales. Finding new ways to communicate, reach and engage with customers is crucial when a physical presence is no longer possible. Moving operations online doesn’t need to be daunting. Plenty of platforms exist to help businesses set-up a website or online store quickly and easily, and your payments partner can help you make a smooth transition from a physical to an online checkout. eCommerce platforms may also be a good option to start selling online.

3. Do good

Businesses that are going above and beyond to help their communities have a two-fold benefit: helping people in a time of need, of course, and making a good, lasting impression. If donating money is not an option, see what you can do with any extra time or supplies, or consider offering discounts to key workers. Do what you can – for others, and for your business.

4. Use your downtime wisely

It’s not all doom and gloom: nearly one in five (19 per cent) SMEs say a benefit of coronavirus slowdown has been the ability to have more time to think about the future. With lockdown measures set to ease over the next few months, now is the time to take stock of your long-term goals and work with partners to be in a place of strength as life returns to normal. Two-thirds of Enterprise Nation members say they’re looking to diversify their business to mitigate future risks (like coronavirus).

5. Start upskilling

A pause in business, as usual, is also a good time to brush up on skills. Around three-quarters of Enterprise Nation members plan to work on the business. The most popular skills for honing are marketing and digital, with two-thirds saying they plan to increase online capacity.

Share