Nearly half (48 per cent) of global consumers expect to be hit by a data breach at some point in the future, while 30 per cent have already fallen victim to one, an increase of 7 per cent compared to 2019. That’s according to new research from security solutions provider, OpSec Security.

OpSec’s Annual Consumer Barometer surveying 2,600 global consumers also found that 46 per cent of data breach victims have been contacted by brands about their data being compromised two to five times, while 9 per cent have been contacted more than five times. This has led over half (55 per cent) of consumers to believe that companies aren’t doing enough to protect their data, the research found.

Bill Birnie, SVP OpSec Security and general manager OpSec Online, commented: “The frequency which data breaches are occurring is leaving many consumers desensitised. In fact, our research found 30% of those who have been the victim of a data breach were unsurprised when they found out about it. However, this desensitisation is often also paired with the expectation that organisations will have the protections in place to safeguard personal data and credit card details, and that the consumer will be reimbursed for any resulting monetary losses. Despite this, large-scale data breaches are continuing to damage brands, as 64 per cent of victims have lost trust in the company or brand that lost their data.

“As many consumers now run much of their lives online following the impact of COVID-19, businesses must be more proactive about cybersecurity and online consumer protection than ever, with solutions in place to stop these threats in their tracks. Failing to do so can be extremely costly not only in terms of compliance with data management regulations, but also by customer loss. 28 per cent of consumers who have lost trust in a company due to data breaches say they won’t shop with the brand again.”

OpSec’s research also revealed that of the 40 per cent of consumers who were affected by data theft, only 9 per cent of all those who had fallen victim to phishing schemes had any money returned.

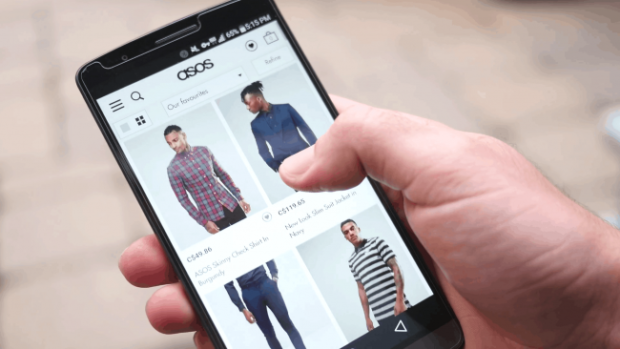

As eCommerce has become the preferred way to purchase items for many consumers, accelerated further by COVID-19, consumers are likely to be more concerned than ever before about using their credit card online. The research found that almost half (47 per cent) of consumers are concerned about using their credit card to make a purchase online, with worries stemming from the possibility of hackers stealing their personal details (62 per cent), scammers stealing their money (58 per cent) and identity theft (57 per cent).

Mr Birnie, added: “Keeping consumers safe online encompasses everything from safeguarding their data and credit card details, to protecting them from those selling counterfeit goods. Brands must take a proactive approach to consumer safety and the best way to achieve this is by partnering with experts, such as OpSec, to ensure they have the tools and processes in place that allow them to quickly detect any possible threats and take the necessary action to prevent any attacks.”

Share