UK households are set to be £3 billion worse off this Christmas compared with last (Q4 2023 vs. Q4 2022), new research from ShipEngine and ShipStation suggests. This is due to high levels of inflation continuing to erode spending power for many households as the cost-of-living climate drags on. The research was commissioned by their operating company, Auctane, in partnership with retail consultancy, Retail Economics.

To cope with the ongoing challenge, savvy shoppers report that they intend to start Christmas shopping earlier, use online marketplaces to stretch their budgets and cut back their overall spending. Indeed, UK consumers look set to spend £17.9 billion on online marketplaces this Black Friday and Christmas as they search for the most competitive prices. Across the eight markets surveyed (UK, US, Germany, France, Spain, Italy, Canada and Australia), the Peak Season Report 2023 predicts that online marketplaces will account for almost £202 billion worth of sales over the peak season.

The state of play this peak

As high interest rates and cost of living pressures continue to pinch personal finances in the UK, with households predicted to be £3 billion worse off due to inflation, peak season 2023 is set to be impacted by a cautious consumer backdrop. 79 per cent of UK consumers surveyed stated they plan to cut back on non-food spending related to Black Friday and Christmas – up 9 per cent on last year. Specifically, 34 per cent of UK consumers cited inflation and 22 per cent highlighted a lack of savings, as their biggest concerns heading into peak season this year.

That said, retailers appear to be more optimistic about prospects for peak demand, with almost two-thirds of online merchants surveyed stating sales volumes will broadly align with last year and 24 per cent expecting volumes to rise on last year.

While the consumer backdrop might be tough, there is reason for optimism for online prospects, with 57 per cent of consumers across the eight markets surveyed planning to do most, if not all, of their holiday shopping online – up from 49 per cent last year. Looking at the UK market, 64 per cent of consumers plan to do the majority of their shopping online.

Tom Forbes, SVP Enterprise Revenue at Auctane, ShipEngine and ShipStation’s operating brand said: “Cautious consumers and unpredictable economic conditions won’t dim the Christmas shopping spirit of UK shoppers, who are set to hunt for discounts, deals and value, as they try to get the most bang for their buck this year. After a grey summer in the UK, retailers will look to start promotions earlier than ever, with some already having started, as they look to shift any leftover inventory to make space for seasonal autumn and winter stock.

“Marketplaces are set to play a huge role at this peak with younger consumers spending more than ever on these platforms, which enable them to easily compare prices from different sources, while offering great choice and flexibility. Looking at delivery, the value of speed must not be underestimated with online shoppers often willing to pay more for quicker, more convenient deliveries to ensure they get their gifts on time.”

Early shopping becomes the norm

UK consumers are the most likely to be ‘early bird’ shoppers, with 40 per cent of UK consumers surveyed planning to start their Christmas shopping before October. Looking at this further, 15 per cent of those expecting to shop earlier stated they already started shopping in August. The research also suggests that retailers will look to jump on this trend, as early shopping becomes the norm. One in four merchants surveyed intend to increase the number of their holiday promotions this year, with the same proportion planning to launch promotions before October.

The impetus to shop early and benefit from promotions over the holiday season is particularly pronounced among younger shoppers. Across all markets surveyed, 44 per cent of digital natives (consumers under 45) intend to engage in their festive shopping during promotional periods like Black Friday and Cyber Monday.

Conversely, older shoppers surveyed report being more likely to adopt more traditional approaches to better manage budgets for their festive purchases. These include self-imposed spending limits, trading down to value brands and using cash to help them stick to their budget.

Online marketplaces look set to be the most popular channel of choice for online shoppers this peak season. The research highlights that across the markets surveyed, almost 90 per cent of consumers plan to shop on online marketplaces, with this figure rising to 95 per cent for UK consumers. The research also reveals that around one in every two online orders over the holiday season looks set to be made via an online marketplace.

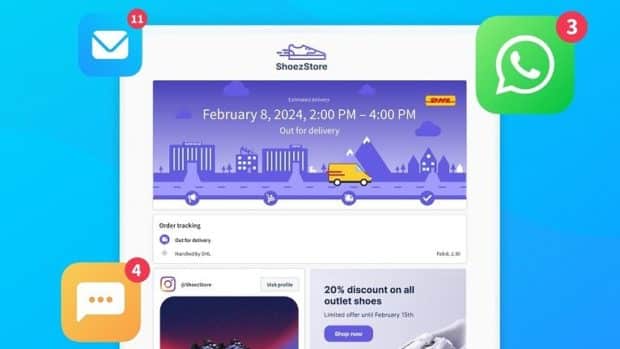

Driving the popularity of online marketplaces is that consumers feel they offer better value and provide a platform that allows them to easily compare products and prices. In fact, 77 per cent of UK shoppers believe online marketplaces offer better value than individual retailers, and almost half of UK consumers state that more competitive prices and deals are offered by marketplaces. Additionally, delivery is having an impact on this channel, with 71 per cent of UK consumers surveyed reporting that online marketplaces usually provide a fast and reliable delivery experience.

Richard Lim, CEO of Retail Economics said: “The squeeze on incomes has become a war of attrition for many households who have dwindled down their savings as the cost of living crisis drags on. Savvy consumers are using all means necessary to manage their budgets by shifting more of their spending to marketplaces to search for bargains, searching for pre-loved products and starting their festive shopping earlier to spread the cost.

“Retailers will have to work harder than ever this year to keep prices competitive while catering for more demanding customers who want to shop on and off-line in a manner that suits their needs.”

There is a shift in consumer deliveries priorities and preferences during peak season vs the rest of the year. The cost of delivery has been by far the most important factor for consumers, however, during the peak season, while the cost of delivery remains significant, its influence appears somewhat tempered, with speed becoming equally as crucial. Almost 70 per cent of UK consumers highlight the speed of delivery, alongside cost, as the two most important delivery factors. Yet, less than a third of merchants surveyed plan to offer delivery of two days or less as standard (two days or less).

Unsurprisingly, the biggest concern for UK consumers when it comes to delivery this peak season are late deliveries, with 42 per cent of consumers highlighting this. Alongside timeliness, there are mounting concerns around missing and stolen parcels, with 41 per cent of UK consumers identifying this as an issue.

Looking at willingness to pay for delivery, our survey discovered that over half of UK consumers report being open to paying up to £7 extra for same-day delivery and 41 per cent would pay that amount for next-day delivery. Across the markets surveyed, willingness to pay rises to as high as 78 per cent among under 45s – the most commercially significant consumer demographic for online retail. These digital-native shoppers, often time-poor, place a high value on speed and convenience.

Share