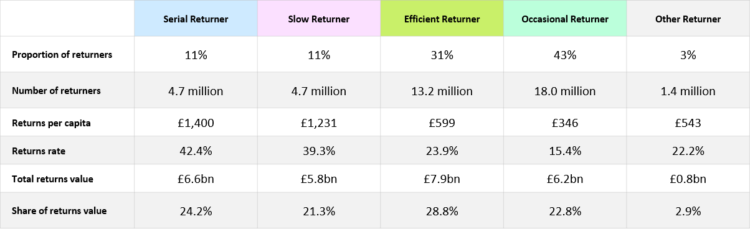

A silent crisis of ‘serial returns’ is eroding retail profit margins as uncovered in the Annual Returns Benchmark Report 2024* conducted by ZigZag, in partnership with Retail Economics. Serial returners, accounting for 1 in 10 (11 per cent of) online shoppers that make returns, are generating a quarter (24 per cent) of all online non-food returns. They are projected to generate £6.6bn of online returns in 2024, as total UK returns across non-food are forecast to tip £27.3bn.

Serial returners are skewed towards younger shoppers engaging in new behaviours unseen in previous generations, frequently over-ordering with the intention of returning a high proportion of items. While serial returners represent just one of four major cohorts of consumers engaging in returns (including slow returners, efficient returners and occasional returners), they generate a disproportionately high share of returns which are often delayed, adding cost and complicating stock management for retailers.

Slow returners represent another key segment retailers need to focus on to reduce the impact of returns. Slow and serial returners together account for less than a quarter of all returners (22 per cent) but generate almost half of returns (45.5 per cent). While serial and slow returners share similarities such as being younger consumers who shop predominantly online, serial returners make returns with deliberate intent (e.g. for staging or bracketing) while slow returners are more impulsive buyers, often making returns out of buyer’s remorse.

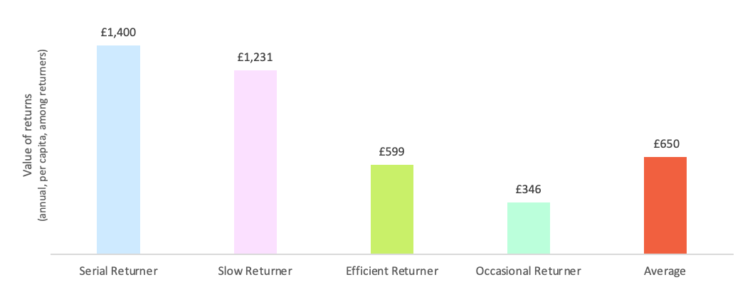

Fig 1 & 2: Returners can be considered across four key cohorts

On an annual basis per person, serial returners are projected to send back a staggering £1,400 worth of non-food products this year – more than double the value of retail products expected to be returned by efficient returners (who promptly return items, typically only returning a small percentage of orders) and occasional returners (who rarely returns items, unless they fail to meet expectations).

Sub-optimal returns policies are driving opportunistic behaviours, with fast fashion brands such as H&M, Zara, and PrettyLittleThing having to introduce fees for online returns to discourage excessive returns and offset expenses. To counteract the impact of serial returners in particular, some brands including ASOS have introduced higher returns fees for individual customers and deactivated accounts altogether.

Bracketing, Wardrobing and Staging

Generational divides are clear across three shopping behaviours, often adopted to navigate returns – bracketing, wardrobing and staging. More than two in five (42 per cent of) shoppers admit to returning items because of over ordering sizes or colours – known as ‘bracketing’. Here, just 16 per cent of Baby Boomers engage in this behaviour across any retail category, compared to an eye watering 69 per cent of Gen Z consumers that do.

In clothing and footwear, which suffers from the highest returns rates compared to other categories, overall 16 per cent of shoppers admitted to having bought clothing or footwear online just to use for a short time like a social event – known as ‘wardrobing’ and 15 per cent have bought clothing or footwear online to showcase on social media – known as ‘staging’. Both of these practices rise to over a quarter among Gen Z shoppers.

Discussing the findings, Al Gerrie, CEO of ZigZag, commented:

“There have always been good and bad returners but the rise of serial returners, in particular, is likely to cause alarm for retailers. Led by younger shoppers, this cohort is exploiting retailers and forcing them to make more controversial and divisive actions. Retailers will continue to clamp down on spiralling costs and returns fraud by introducing paid returns and policies that hone in on abusive returns behaviours, like wardrobing, staging or bracketing. Education also plays a pivotal role. Retailers must ensure customers have accurate product information – consistent sizing, clear descriptions and transparent return policies – so that confidence, not abuse, drives buying decisions.”

The Cost to Retailers

In light of high-profile cases of retailers introducing paid returns, it is clear that managing returns has become critical for profitability. The cost of returns varies widely depending on product category, seasonality, and return speed, impacted by postage, packaging, depreciation, labour, and missed sales opportunities.

Striking the right balance between recouping costs versus deterring customers is critical. Nearly half (49 per cent) of online shoppers have abandoned purchases due to unfavourable return policies. The report also indicates that consumers are willing to pay £2 for returns on average, with only minor differences between the least affluent (£1.70) and the most affluent (£2.25) customers. Additionally, although over half (55 per cent) of online shoppers are unwilling to pay a small sum at purchase to guarantee cheaper or free returns later, serial returners are most open to paying an upfront fee for this benefit.

This insight is further supported by ZigZag’s recent research with YouGov which found that 71 per cent of consumers would prefer paying a flat fee for returns rather than facing higher product prices.

Richard Lim, CEO at Retail Economics, added: “Serial returners are quietly eroding retail profitability in ways many retailers are only just beginning to understand. The rise of opportunistic shopping behaviours, where many people intentionally buy large quantities of goods with the intention of returning most of them, is placing an unprecedented strain on retailers. This not only impacts the bottom line through increased operational costs but also creates significant challenges in inventory management and sustainability efforts.

“Retailers are facing thinner margins and must urgently rethink their approach to returns management by integrating advanced returns solutions and educating consumers about the implications of their returns, balancing customer satisfaction with profitability.”

Share