Return on marketing investment (ROMI) is what every marketer wants to achieve. But automating marketing metrics and extracting accurate ROMI data can be a real challenge.

There are two key reasons for this: firstly, the lack of an agreed definition of ROMI (or indeed a methodology); and secondly, the absence of data and technology to extract and report on it accurately.

In terms of definition, ROMI evaluation can be done in the short or long term. Short term ROMI measures the return from immediate sales that you can associate with specific marketing activities. Long term ROMI also takes into account the longer-term customer value that is derived from those sales, as well as the brand impact of advertising which can be monetised over a much longer period.

In this blog, we’re focusing on short term ROMI, specifically measurable results within a 90-day timeframe after online or offline direct marketing activities have taken place. (These are activities targeted at individuals, as opposed to indirect marketing activities, such as TV or press advertising).

Two types of short term ROMI

For short term ROMI, there are two different ways of calculating effectiveness:

Investment ROMI

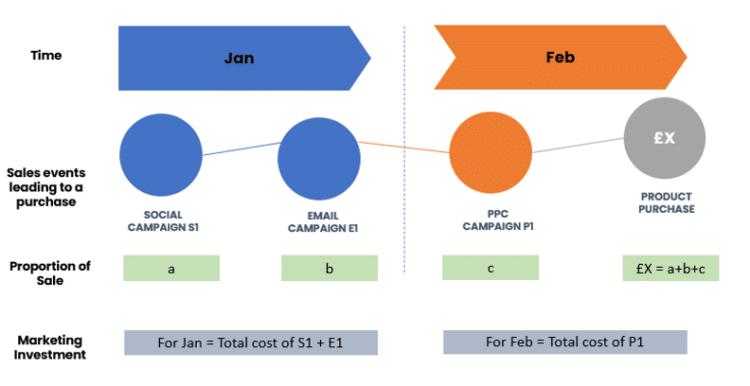

This is the return that takes into account the full costs of marketing campaigns and includes all the measurable results within a 90-day period. We count the measurable benefit as the value that accrues to all the events in any customer journey leading to a sale that can be attributed to a marketing activity – for example, a sale of £X value after events such as responding to a social media advert, opening a follow-up email and visiting an eCommerce website via Google PPC.

We allocate the £X value across these three events according to the significance each has in contributing to the sale. The social media advert will receive its share of £X and this goes into the ROMI calculation for this particular activity.

The table below shows a calculation of Investment ROMI. Marketing campaigns A, B, and C launched in January cost £30,000 total, however they impacted customer journeys that carried on until March. Campaign A contributed to a number of sales events that amounted to a combined value of £12,000 in January. The overall Investment ROMI calculation of 2.17 shows the combined return from all January campaigns.

| Investment ROMI = 2.17 | ||||||

| Campaign costs | Sales Impacts | |||||

| Jan | Feb | Mar | Total | Campaign ROI | ||

| A | £10,000 | £12,000 | £6,000 | £1,000 | £19,000 | 1.90 |

| B | £15,000 | £18,000 | £12,000 | £1,500 | £31,500 | 2.10 |

| C | £5,000 | £10,000 | £4,000 | £500 | £14,500 | 2.90 |

| Total | £30,000 | £65,000 | 2.17 | |||

Sales ROMI

Sales ROMI looks at the return from the costs of the customer journey sales events that led to sales in a particular period. So, from the table below, sales in January amounted to £40,000, but the campaigns that caused the sales events to happen that led up to these sales may have been launched at any point in the 90-day window before each sale.

| Jan | Feb | Mar | ||

| Overall sales | £40,000 | £50,000 | £60,000 |

| Campaign costs | Number of sales events | Cost per sales event | |||

| A | £5,200 | 500 | 1,000 | 1,200 | £2.00 |

| B | £9,000 | 2,000 | 3,000 | 4,000 | £1.00 |

| C | £12,000 | 250 | 1,000 | 10,000 | £4.00 |

| Overall campaign costs to be allocated to sales | |||||

| A | £1,000 | £2,000 | £2,400 | ||

| B | £2,000 | £3,000 | £4,000 | ||

| C | £1,000 | £4,000 | £40,000 | ||

| Total Costs | £4,000 | £9,000 | £46,400 | ||

| Sales ROMI by month | 10.0 | 5.6 | 1.3 | ||

Following this approach, we look at the individual customer journeys that precede each sale in January and add up the costs associated with each journey’s sales events. These events may have been caused by a mix of online and offline campaigns that are also impacting sales in other months, such as December and February.

In the case of January, the sales events were all caused by campaigns A, B and C. Campaign A contributed 500 sales events, campaign B 2000 and campaign C 250. In terms of cost per sales event, campaign A contributed to a total of 2,700 events in this example and, if the campaign cost was £5,200, the cost per sales event is £2.

The value of sales of £40,000, divided by the combined sales events costs of £4,000 that caused it, produces the Sales ROMI calculation of x10 for January.

Delivering Investment and Sales ROMI metrics

Expertise and technology is needed to automate the ROMI evaluation process, knitting together all the different types of sales events and linking them to actual orders. The types of data required will normally include website browsing, e-commerce, emails, offline contact history and order processing.

UniFida’s automated approach is to use a Customer Data Platform (CDP) for data integration processes, but there are alternative platforms that deliver a similar result. It’s worth noting that for accurate evaluation you will need 100% of browsing activity data and not just the sample that Google Analytics provides (unless you buy the very expensive GA 360 at around $150,000 pa).

With the data assembled there are four key steps:

- Build a table of orders connected to all the sales events that are associated with them and with each sales event also linked to a campaign or a channel to be measured.

- Apply a weighting to each sales event so that the value of the order can be fairly attributed across these events. We find that on average there are around three sales events before each order and these can come from several channels. There is a huge amount of online information about weighting systems, much of which is not based on any science. We use Haensel AMS to provide our weighting algorithms due to the statistical research on which they are based and the fact that they can be applied at an individual order level. Some people use Markov Chains theory which is sound, but which can only work at the level of a substantial table of data and so is not good for evaluating individual campaigns or tests.

- Enter the costs of each individual campaign. These costs are essential and may be problematic where there are large numbers of campaigns, as often happens with emails. In this case, you may decide to enter costs at a channel level if you are looking at Investment ROMI. For Sales ROMI, individual campaign costs are required.

- At this point you can follow the logic in the tables above to calculate whichever flavour of ROMI you require.

What are the benefits?

There are multiple other measures such as impressions, opens, clicks, etc. which give an indication of the level of interest in a campaign. However, they all fail to answer the key question: was the marketing expenditure in itself justified?

The primary benefit is that ROMI calculations are the only way to fully and accurately justify investment in marketing campaigns.

ROMI provides a yardstick by which the performance of different campaigns and channels can be evaluated, and from that, informed decisions can be made about budget allocation. We are not suggesting that all budget allocation decisions should be based on ROMI, but where ROMI for a particular activity is low, you need to find other ways to justify the expenditure – for example, an activity may play a small but nevertheless important part in a significant number of sales.

ROMI can show how investment results vary at different times of year and hence guide you towards spending your budget where you are getting the best returns. For example, catalogues may do better in the colder months when people have more time indoors to study them.

There is one very important by-product of the ROMI calculations. If you regard the month-by-month ROMI results as a time series of information, then there will be periods when you have spent more or less in particular channels, with varying ROMI results. This data, when there is enough of it, will enable you to start constructing saturation curves that can show that, as you spend more in a particular channel, returns will go down, and vice versa.

Saturation curves are critically important for budget optimisation. Unless you know how changes in the level of budget for a channel impact their ROMI, it is simply not possible to plan with any certainty how best to shift budget between channels.

Proof of concept

UniFida can deliver the required expertise and technology ‘out of the box’ to help you automate ROMI evaluation. We can start with a low-cost proof of concept to demonstrate how ROMI can be calculated for your business. For more information visit www.unifida.co.uk

Share