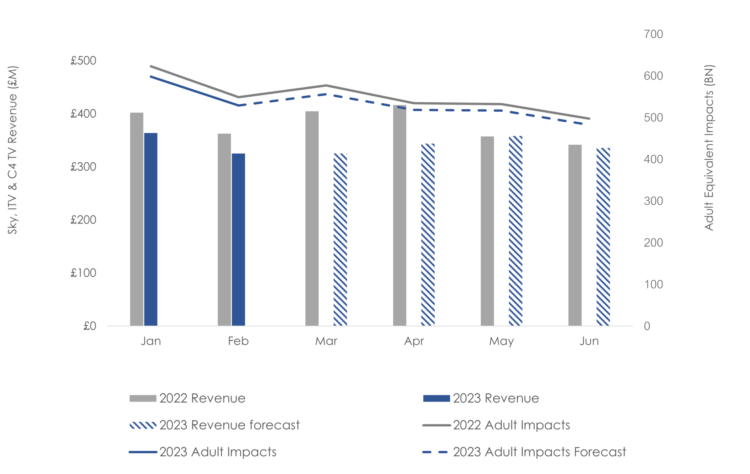

The Q1 TV market has seen significant revenue declines YoY with Q1 expected to consolidate at -12 per cent and half one at -10 per cent.

The Saleshouses and WARC are still estimating the year to finish flat or slightly under, with revenue predicted to recover into H2. What does this mean for TV advertisers?

February TV viewing overview:

Linear audiences continue to trend down YoY with overall adult broadcast impacts down -3.7 per cent YoY in February – consistent with -3.9 per cent in January,.

•ITV1’s adult impacts were down –12 per cent YoY, February 2022 was strong for ITV1 with programming with Trigger Point and additional episodes or Ant and Dec Saturday Takeaway vs. 2023.

•ITV digital impacts were up +4 per cent YoY, with ITV2 up 46 per cent driven by Love island airing through February.

•C4 Terr is also down in YoY -12.5 per cent driven by 1634’s (21 per cent) and ABC1 audiences (-15 per cent).

•1634Ads and ABC1Ads are both down -9 per cent YoY in February 2023 across all broadcast with older audiences still seeing the least decline (55+ down –2 per cent YoY).

| Feb 2022 | Feb 2023 | YoY change | |

| Adults | 54,870,266 | 52,868,478 | -3.7 per cent |

| ABC1 adults | 23,719,669 | 21,476,600 | -9.5 per cent |

| 1634 adults | 5,002,653 | 4,531,669 | -9.4 per cent |

| Housepersons + Children | 4,609,827 | 4,790,497 | 3.9 per cent |

| Adults 55+ | 35,854,788 | 35,233,020 | -1.7 per cent |

| C2DE Adults | 32,700,332 | 32,989,281 | 0.9 per cent |

| All individuals | 165,826,439 | 160,783,675 | -3 per cent |

| Equivalent Adult impacts (000s) | Feb 2022 | Feb 2023 | YoY change |

| ITV1 | 14,468,279 | 12,710,827 | -12.1 per cent |

| ITV digital stations | 4,904,086 | 5,107,466 | 4.2 per cent |

| C4TV | 4,387,543 | 3,837,333 | -12.5 per cent |

| C4 digital stations | 9,177,915 | 9,209,472 | 0.3 per cent |

| Skymedia | 19,300,259 | 19,466,724 | .9 per cent |

| others | 1,087,954 | 1,271,130 | 16.8 per cent |

| Total Broadcast | 54,870,266 | 52,868,478 | -3.7 per cent |

Upcoming sponsorships and exciting opportunities for brands

Sitting on a Fortune -ITV1

The show will have 6 consecutive Saturday night episodes allowing brands to create a good presence on ITV’s main channel during peak hours. In 2021, the series averaged at 1.9 million viewers which skewed towards an older, lower social grade demographic. 65 per cent of the audience were categorised in the 55+ sub demo, whilst 59 per cent of the audience were C2DE Adults.

Weekend Breakfast- ITV1

ITV are offering a 5-month partnership package with their Weekend Breakfast programming. Across the shows, ITV’s Weekend Breakfast package is expected to reach 8.6 million viewers on average, indexing well for upmarket women and housewives.

Below Deck – C4

A sponsorship with Below Deck is a great opportunity for brands with a young and female target demographic. The sponsorship will run from June 23 – Dec 23 and has an estimated media value of £1.2m. The series of Below Deck in Jan 23 averaged at 0.47 million viewers and is expected to perform similarly in late 2023.

Short-term incentivised sponsorships

HorrorXtra

Sky are offering a Short Term Movie Package (17:00-29:00) on HorrorXtra during peak and late night dayparts. This channel is the home to the best horror movies and series, from science fiction to futuristic fantasies. Between April-June, this sponsorship is expected to reach 4.45 million Adults, skewing towards a male audience aged 55+. The exit £CPT is expected to be sub £1.

Music Mega Package

This is a full music channel sponsorship across Now 70s, Now 80s, Now Rock and Clublands. Between April-June, the channels are expected to reach 4.55 million Adult viewers. This opportunity is great for brands targeting an older generation, especially women. The exit £CPT is expected to be sub £1.

The impact of Love Island on the TV market

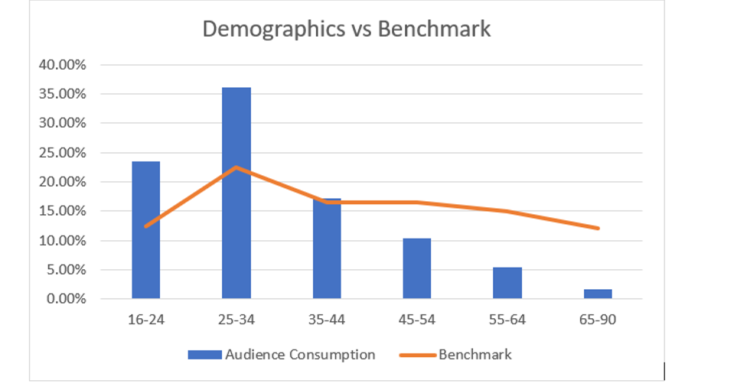

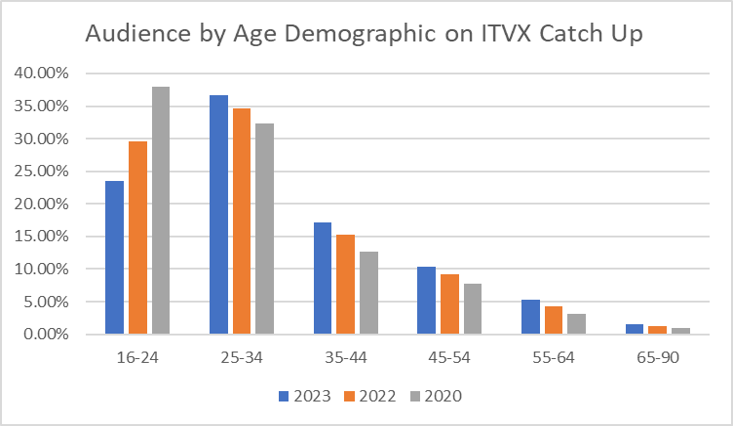

Love Island alone made up around 53 per cent of all ITV2’s AD1634 impacts and 42 per cent of all adult impacts. Across all broadcasters, the series accounted for a 33.6 per cent share of all young TV viewers aged 16-34, averaging at 714,000 viewers. The below graph represents Love Island viewing on ITVX compared to other streaming programmes during time period analysed.

•LI attracted more ad1624s than the average programme on ITVX with a share of 23.5 per cent (double the share of consumption seen on other programmes)

•The series skewed towards women (76 per cent avg.) which is c.8 per cent higher share than the average ITVX programme.

- Compared to LI 22 and 20, ITVX has seen growth in the share of all audiences 25+.

- ITVX has seen a –6 per cent drop in AD1624 viewing YoY

- The AD2534 sub demo has maintained the highest consumption share YoY accounting for 37 per cent of streaming hours in 2023.

- AD2534 also recorded the highest share on linear TV, therefore Love Island is a programme that is excellent for reaching this demographic.

Latest digital market update:

Meta announced that they were working on a new “text sharing” platform, likely as a rival to Twitter to try take advantage of the current state of play.

Microsoft announced the “co-pilot” initiative by using Chat GPT integration into its products.

YouTube was under fire for collecting viewing data for children under the age of 13 – an official complaint has been logged with the ICO.

BARB, the UK’s measurement company for TV is expanding to measure “fit-for-TV” content on video sharing platforms, alongside its existing measurement of broadcaster’s content on YouTube.

Pinterest announced a new format called “Premiere Spotlight” ad which will allow advertisers to access a 24-hour ad placement on the app’s search page.

Social and Display trends

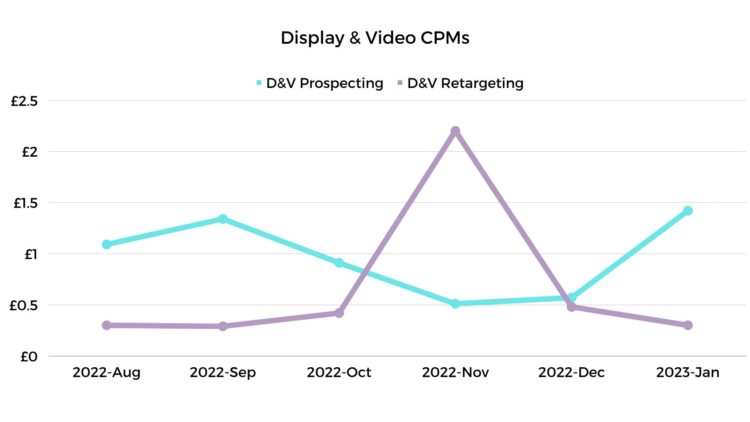

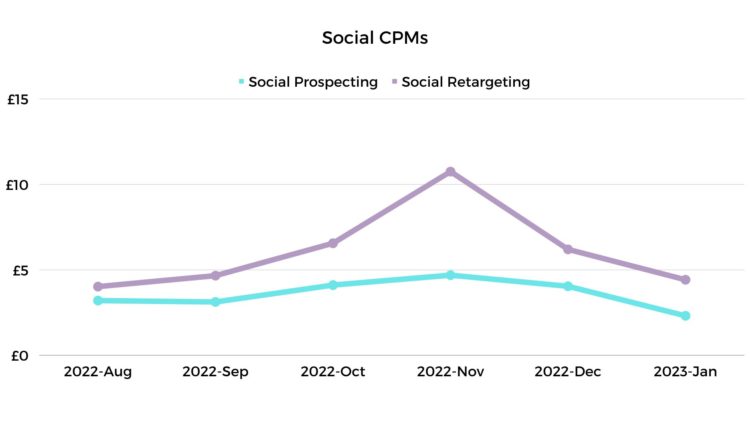

Maria Yiangou, Digital Director, All Response Media comment: “Prospecting CPMs across display and video continue to rise in Q1, however, retargeting audiences are getting cheaper than prospecting for the first time in a while in March.”

“The CPMs across social channels remains low in Q1 versus the highs of Q4 last year with a fairly steady average of £4 across both prospecting and remarketing.”

Chat GPT spothlight: what inspires people to use Chat GPT?

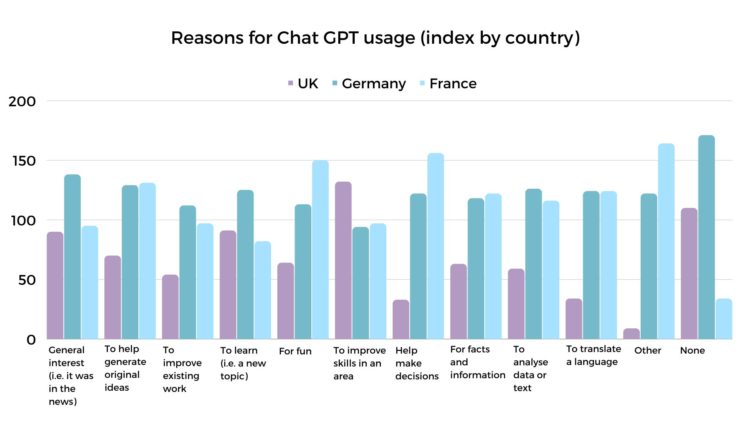

Every month GWI asks a new topic question to their panel. In March they asked what was the main reason for using Chat GPT:

Source: TGI 2023

- With Chat GPT dominating headlines in Q1, GWI asked people across UK, Germany and France what their most common reasons for using the tech was

- France is paving the way with the lowest index of people who say they don’t use it at all with helping them make decisions and to have fun the most popular reason for checking it out.

- Germany broadly indexes well against all topics with the fact it is in the news being the main driver for users

- The UK seem to be using it to upskill with improving skills index the highest for them

Maria Yiangou, Digital Director, All Response Media comment: “Although Chat GPT is exciting, it is important to note that it is not a replacement for human input. AI is still in the early stages of development and is not capable of performing all the tasks that humans can – and not to the degree that humans can either.”

“In order to get the most out of tools such as ChatGPT, we need to look into how it can be integrated with human-centred workflows. Chat GPT has the potential to be a powerful tool for enhancing what we can do in the workplace and can work to complement the human workplace, not replace it.”

To learn more about All Response Media click here.

Share