Nearly half (49 per cent) of UK consumers are more concerned about becoming a victim of fraud now than they were in 2021. That’s according to research released by payments platform, Paysafe which indicates that UK consumers are prioritising security over convenience when making online purchases, as the impact of the cost of living crisis continues to fuel financial worries for UK households.

The research revealed that 60 per cent of people in the UK are so concerned about fraud they feel it is simply an inevitable risk of online shopping, a major jump from the 45 per cent who said the same in 2021. These fears have caused 49 per cent to not feel comfortable entering their financial data online to pay for goods and services, another jump over the 38 per cent who felt this way in 2021.

According to the latest Fraud report from Money.co.uk, fraud victims in the UK saw an average loss of £7,000 to online criminals in 2021. As Brits prepare for the highest gas price jump in history, it’s clear that losses of this amount would be even more impactful for victims.

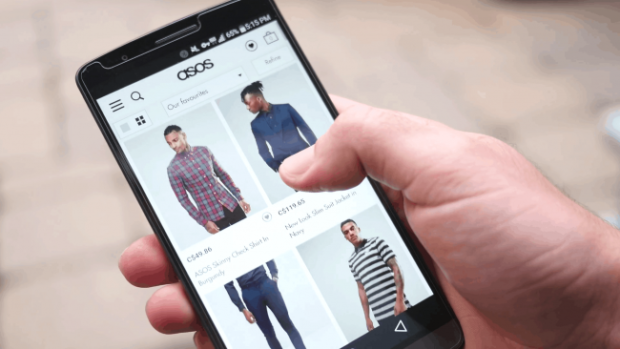

For years the payments industry has struggled to balance the competing needs of security and convenience for customer satisfaction, and having a streamlined customer experience remains essential, but growing concerns around fraud have put security into the spotlight. Nearly twice as many consumers chose security (47 per cent) over convenience (24 per cent) as the most important factor when paying for an online purchase.

Although security experts often discuss the limitations of password protection, consumers are now rallying behind the password as a familiar means of security. Over a third (41 per cent) said they trust passwords more than biometric authentication methods (a 6 per cent uptick over 2021). That said, confidence in biometric authentication is also growing with 53 per cent agreeing biometric authentication makes online payments more secure, a noticeable increase against 45 per cent last year. With fraud concerns clearly at the top of the agenda for consumers, merchants that offer multi-factor authentication methods can instil confidence in consumers that their transactions are secure.

Despite all these concerns, a majority (55 per cent) of consumers think payments are more secure than they were a year ago. And 50 per cent of respondents are satisfied with the current balance between security and convenience, which is in stark contrast to 2021, when only 24 per cent were satisfied.

But the amount of trust merchants enjoy is dependent on the amount involved. While 75 per cent currently say they feel comfortable buying from a peer-to-peer platform and 54 per cent from an online retailer like Amazon, this is only the case if the item costs no more than £150. For amounts over £1,500, confidence is low across the board, suggesting there is still work to do for merchants in highlighting the benefits of alternative payment and security methods within the industry.

Chirag Patel, president digital wallets at Paysafe, said: “It’s been well-observed that during times of financial crisis, fraud rates rise. It happened during the height of the pandemic, and now, as we enter a recession in the UK, consumers are right to be alert to the dangers in the online payments world. Respecting customers’ concerns is paramount, however striking the right balance for convenient everyday use remains critical to retain customers. Offering a variety of alternative payment methods and security options will do much to assuage consumer fears and keep financial details safe, while also protecting the consumer experience.”

Share