With seventy of the UK’s largest supermarket and retail chains adding their names to a letter to Chancellor Rachel Reeves warning of job losses as well as price increases, one might hope that the ‘former bank economist’ is listening. Bank of Engand Governor Andrew Bailey has also said in an address to MPs at the Treasury Select Committee, that having seen the letter he accepts that the risk of job losses are real.

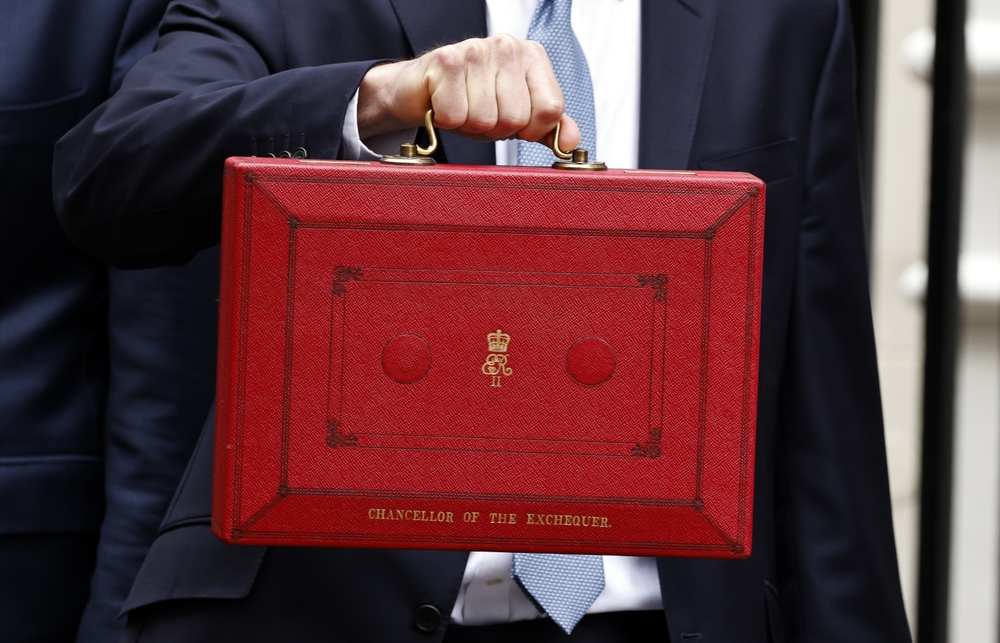

The letter, orchestrated by the BRC, stated clearly that the Budget which introduced higher employers’ national insurance contributions, including a lowering of the remuneration level from which the tax would apply, coupled with an increase in the minimum wage would hit retail businesses hard.

As one of the largest groups of employers, retailers and hospitality sector businesses, all of which operate on tight margins, employ very significant numbers of full and part-time workers in both customer-facing and support roles. For many of these businesses, the only viable option will be to slash labour and other operating costs. Whether through shortening outlet opening times once the Christmas season is over, closing underperforming outlets, and reducing headcount across the board, wherever possible.

Some have already begun to announce job cuts and for very many SMEs and independent retailers, the impact of these additional overheads may be the final straw.

Had the Chancellor conducted a thorough review of the impact on retailers and the hospitality sector before expecting all to be in a position to shoulder further cost burdens, she would have seen that most SMEs have borne the brunt of constantly rising costs and falling margins over the past few years. For some, revenues have plummeted as consumers have struggled to cope with ‘the cost of living’, and the resultant lower revenue input has plunged businesses into the red, with some forced to admit defeat and enter administration. It isn’t rocket science to appreciate that many businesses are already struggling to ‘keep the lights on’ and that as they are forced to let employees go, to shutter stores, that claims for unemployment benefits will increase, and that town centres will become ever more desolate.

Mark Tan, International Corporate Tax Partner at law firm Spencer West LLP commented: “These tax hikes reflect the challenging balance between fiscal responsibility and economic growth. While the need for increased tax revenue is undeniable, we must focus on how the government allocates this revenue to drive sustainable growth. Businesses will, as expected, pass costs on to consumers or employees, but the conversation cannot stop at rising prices or stagnant wages.

We need to look forward: What is the government’s plan to foster growth through enhanced inbound and outbound trade relationships? Easing trade restrictions to facilitate smoother trade with the EU and strengthening bilateral international trade treaties must be pivotal.

I caution that raising taxes without a clear growth strategy may prompt taxpayers to seek ways to minimise or avoid their obligations. To prevent this, the government must use the increased revenue wisely, investing in areas that genuinely stimulate the economy: such as initiatives that spur innovation, improve infrastructure, and ultimately create opportunities for both businesses and individuals.”

Ed Bradley, CEO, Virtualstock said: “It’s clear that the extension of business rates relief is nowhere near enough to offset the significant financial burdens retailers are now battling with—such as National Insurance changes and increased wage bills.

To give themselves a leg up, retailers must focus on operational efficiency, which means digital transformation has to be a priority. Investments in digital tools can streamline supply chains, cut inventory costs, and improve productivity. Not to mention consumers are increasingly demanding agile, digitally driven shopping experiences. By putting technology first, retailers can mitigate the impact of rising costs, drive growth, and enhance customer experience.

The government, too, must recognise the important role technology plays in supporting the retail sector and the UK economy. Considered investment in tech will be a lifeline for an industry facing significant challenges.”

Share