Misguided has entered into a partnership with Klarna, Poq & Stripe to create a tailored and seamless journey for its UK app shoppers. The app now accounts for over 30 per cent of mobile orders at Missguided.

Luke Griffiths, General Manager at Klarna UK, commented: “They say two heads are better than one, but in our case, three was the magic number. Collaborating with Stripe and Poq meant access to some of the greatest expertise in the payments industry and enabled us to create a unique product, truly tailored to Missguided and their customers. Fearless when it comes to progress, it’s just one of the reasons Missguided have achieved the success they have today. Our Pay later product will give its customers more flexibility, allowing them to try before they buy — and that’s a trend we’re seeing become more in-demand with online-first retailers.”

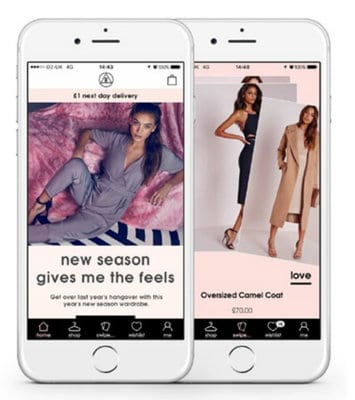

Jonathan Wall, Chief Digital Officer at Missguided added: “Our customers drive everything we do, so it makes sense that we make sure they have the best experience when shopping with us. I want Missguided shoppers to feel excited when they open our app, and making the latest lines and limited editions more accessible through Pay later is part of that mission. Klarna shares our vision when it comes to innovation, and our desire to make life simple, quick and worry-free for our shoppers. Bringing Klarna’s experience together with our existing partners meant we got the best of both worlds, and we can’t wait for our customers to start enjoying flexible payments.”

Iain McDougall, UK Country Manager at Stripe, added: “This partnership bridges the gap between consumer expectations of seamless mobile payments and the complexity of building a first-class mobile checkout. For tech-forward retailers today like Missguided who want to maximise mobile conversion, adding a new payment method like Klarna shouldn’t be reworking your fund flow, but a checkbox. Stripe is radically reducing the complexity of tailoring payment experiences so customers, no matter what device they’re using or where they’re buying from, can check out quickly in a way that suits them.”

Share