China’s slowdown and deflation will create winners and losers in the global economy, market research firm Euromonitor International has revealed.

Lan Ha, head of economic research at Euromonitor International, said China’s post-pandemic economic recovery was slowing because of declining demand for the country’s exports and sluggish growth in domestic consumption.

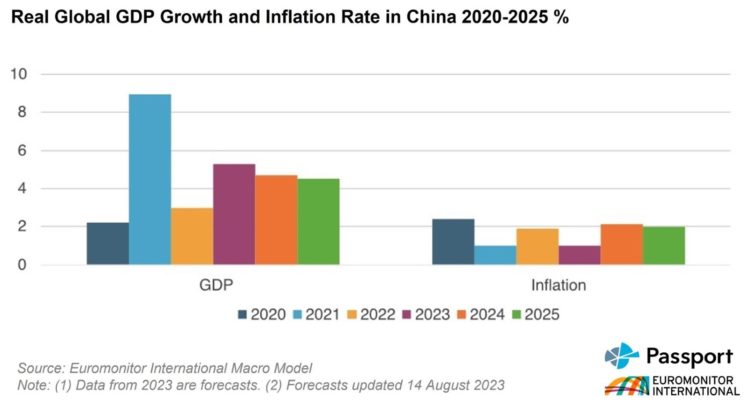

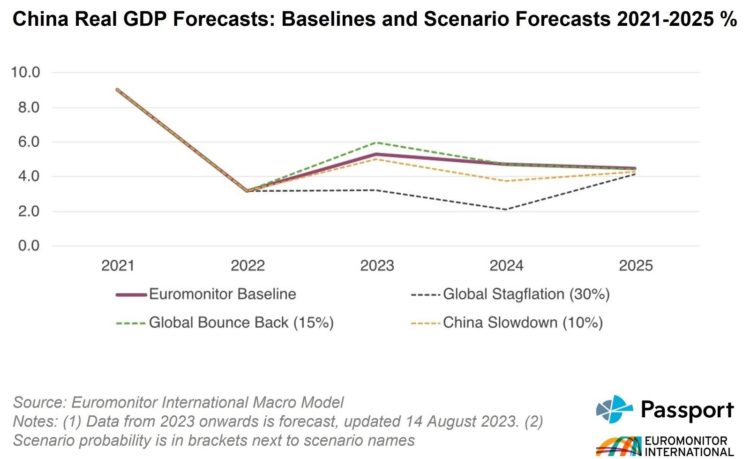

Projected growth rates for China in 2023-2024 are higher than the 3.0 per cent growth the country recorded in 2022. However, a growth rate of around 5.0 per cent is significantly lower than the economy’s pre-pandemic trend, which averaged 7.7 per cent annually during 2010-2019.

To stimulate the economy, the People’s Bank of China cut interest rates in June and August 2023. However, additional fiscal stimulus in the form of tax breaks or incentives for manufacturers is likely to be required to boost economic growth. Ha added that ongoing real estate market problems were sparking concerns for the stability of China’s financial system, risking a deeper downturn for the world’s second-largest economy. This threatened to have a significant impact on the global economy, with important implications for businesses and consumers.

“After a dynamic post-pandemic recovery at the start of the year, China’s economic growth started to lose steam in Q2 2023. Exports, once a consistent growth driver, are now struggling. China’s exports contracted by 14.5 per cent in July 2023 – the fastest decline since the outbreak of Covid-19. Weaker global demand and rising geopolitical tensions are hurting Chinese exporters,” said Ha. “On the domestic consumption side, ongoing real estate market problems are dampening investments, while consumer spending is weakening, as Chinese consumers become more cautious about job, income and economic prospects. Falling consumer demand also tipped consumer prices into deflationary territory, a typical sign of a weakening economy.”

Justinas Liuima, Industrial Insights Manager at Euromonitor International, said that in China’s case, deflation can worsen the country’s debt burden, as the real value of debts rises amid falling prices. As a result, China’s companies and local governments will have to allocate greater financial resources to service debt, leaving fewer resources for spending and investment. According to the Bank of International Settlements, China’s private and public debt burden is already high and reached almost three times domestic GDP in 2022, higher than the debt level of the US.

Although China’s deflation is likely to be temporary, given the base effects and a rise in core inflation, deflationary pressures are significant. The ultimate challenge for the Chinese authorities will be finding a way to stall the self-propelling spiral of lower prices, weaker demand, lower output and higher unemployment, added Liuima.

While a slowdown of China’s economy will lead to overall slower growth for the global economy, the impact on different economies and businesses will be mixed. On the negative side, weaker B2B and private consumption growth will hit exporters to China and retailers in the country. Liuima said that China is one of the largest consumers of machinery, hi-tech goods, as well as luxury goods. In addition, slower growth in China will negatively affect commodity exporters, especially Latin American countries and Australia.

Share