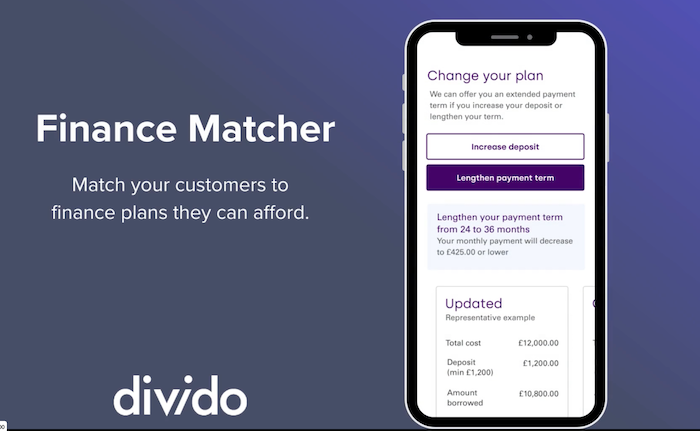

Checkout finance platform Divido has launched ‘Finance Matcher’, a new tool to support UK consumers in finding checkout finance repayment plans that they can afford, supporting merchants to boost sales without compromising on responsible lending standards.

After a soft credit search by the lender, Finance Matcher presents finance options based on consumer affordability, allowing Novuna-enabled merchants to offer adjusted finance payment plans and increase acceptance rates. For example, shoppers get a second chance to adjust their deposit total or extend repayment terms to reduce their monthly repayment amounts. This responsible approach means consumers can complete purchases without overstretching their monthly budget. Further, consumers passing the soft search the first time have an improved experience by easily seeing if they can save money on interest payments by repaying faster, and still be accepted for finance.

Divido estimates that merchants can lose up to 2 per cent of their retail finance sales because consumers unknowingly set monthly repayments too high, which get declined by the lender. For a merchant selling £20 million through retail finance, this can mean £400,000 in lost sales every year.

Todd Latham, CEO of Divido, comments: “When you get all the way to the checkout and get turned down for finance, you’re going to feel a whole range of emotions and none of them is positive. We saw this problem impacting basket abandonment and customer experience, so decided to develop a frictionless finance solution for the moments that matter. With our partners Novuna, we’re proud to launch Finance Matcher, which gives customers a better chance at being accepted for finance, and boosts merchant’s sales at a time when budgets are being squeezed.

“Today’s shoppers are more savvy, with many now actively choosing to shop with merchants that offer them a variety of payment options. Finance Matcher means happy customers, and less money left on the table.”

Today’s challenging economic climate means more consumers are turning to alternative financing options to access necessary funds for the essentials, and sometimes unexpected costs. This year alone, over 36 per cent of consumers have used BNPL more than once because of rising inflation and cost of living. With disposable income set to fall by 4 per cent by April 2024 according to the Resolution Foundation, alternative financing options will become essential.

Divido research earlier this year found that 58.3 per cent of consumers see checkout finance as a tool for helping them manage their finances, 50.4 per cent of consumers would be more likely to complete a purchase if they knew checkout finance was a payment option and 54.2 per cent would consider spending more if this was an option. The research highlighted the opportunity for merchants to maintain and in some sectors boost sales, tap into a new customer base, and retain customer loyalty.

Retailers are aware that consumers have shifted their financing habits to keep pace with the rising cost of living. In fact, last year, 76 per cent of large retailers in the UK had implemented at least one form of checkout finance. Now, they need to make their retail finance programmes work harder for them, to prevent bad customer credit experiences and potential sales losses.

Share