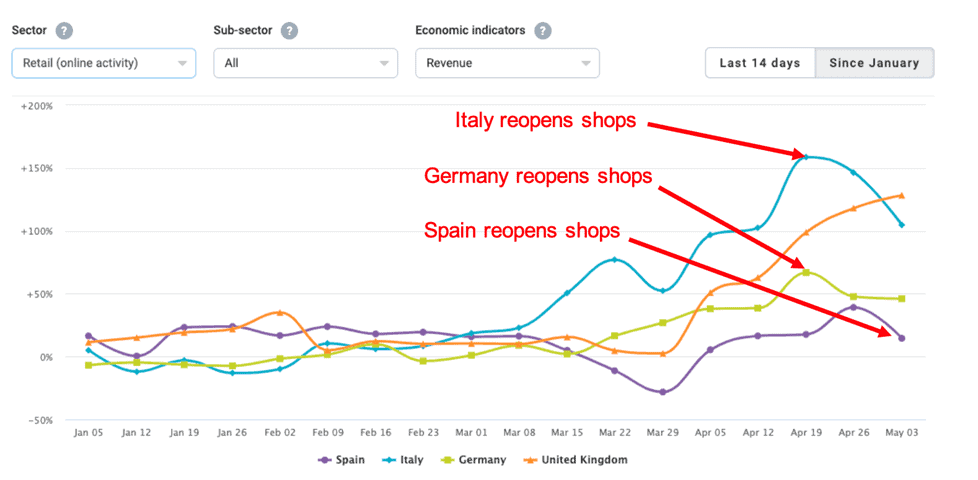

As European countries re-open shops post lockdown, online retail sales growth has dropped considerably, perhaps indicating that consumers are turning to physical stores once more, data from tech firm Emarsys suggests.

Since Germany began to open shops again from 20th April, online sales revenue growth has decreased from 67 per cent (in the week leading up to 19th April) to 46 per cent (in the week leading up to 3rd May) compared with the same time last year.

Italy has also seen a large decrease in online retail sales as people return to physical stores. At the time of shops reopening on the 20th April, Italian online retail growth decreased from 159 per cent to 105 per cent year on year.

Spain began to re-open shops on 4th May, and it remains to be seen whether online growth will shrink from the current 15 per cent during the week leading up to 3rd May.

In the UK, where restrictions remain, online sales growth continues to rise — increasing from 99 per cent to 128 per cent between the 19th April and 3rd May.

Alex Timlin, SVP verticals at Emarsys, explained: “We’re beginning to see the first signs of retail recovery in countries that have lifted restrictions — albeit slowly.

It’s going to be a long journey to get consumers back to shopping in physical stores once again, but the fact that online retail growth is decreasing is a welcome sign for those that run bricks-and-mortar stores.”

These most recent online customer trends were identified by Covid-19 Commerce Insight, a joint project between Emarsys and data analytics provider GoodData showing the impact of Covid-19 on consumer confidence. The insight draws on more than a billion engagements and 400 million transactions in 120 countries, providing a global and regional picture of eCommerce activity and trends — a key indicator of overall economic conditions in these unprecedented times.

Key insights include how the pandemic is affecting the number of online consumer transactions, order numbers, the average order value, types of items purchased and more — in any industry and region in the world — in context of the extraordinary measures taken by governments globally.

Share