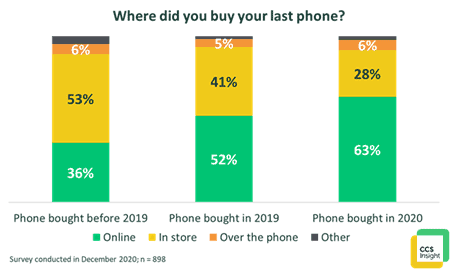

Nearly two in every three people (63 per cent) in the UK who bought a mobile phone last year did so online, according to CCS Insight’s latest survey. This compares with 52 per cent among people who last bought one in 2019 and just 36 per cent of those buying a phone before that.

CCS Insight’s previous surveys into consumer behaviour had already identified solid progress in online sales, and the pandemic has accelerated this trend. In a tumultuous 2020, UK phone shops were open only intermittently and even then with social distancing and limited devices on display for hygiene reasons. In fact, less than 30 per cent of the survey’s respondents can even recall visiting a phone shop in the past six months.

“Rather than waiting for normality to return to the high street, connectivity-hungry Brits are happy to buy devices without seeing them in the flesh first,” remarked Kester Mann, director of consumer and connectivity at CCS Insight. “Our survey results reflect a growing confidence to buy based on listed features, a familiarity with the leading brands, their design and how they work, and recommendations from friends and family”.

But Covid-19 wasn’t the only driver. The decision by Carphone Warehouse in March to close all of its standalone stores wiped out more than 500 retail shops practically overnight.

People in the survey listed a wide range of other factors that prompted them to buy online, such as convenience, lower prices, already knowing which phone they wanted to buy, and not wanting a salesperson to influence their decision.

Technology products lend themselves to online purchases, but the complexity of buying a mobile phone contract, combined with people’s traditional preference to test the look and feel of a very personal device, has meant that phone shops have until now had a leading role in the overall phone buying process. This is now diminishing.

CCS Insight’s survey also revealed the importance of online activities for many aspects of the buying process. Before buying, about twice as many people (40%) researched mobile phones online as visited a store (22 per cent), for example. According to Mann, the trend to online is only set to continue. “The pandemic has brought permanent changes to the way people shop that will fuel further growth in online channels in the coming years,” he remarked.

But it’s not all doom and gloom for the high street. Survey respondents listed a wide range of other reasons to visit a phone shop. Notably, 20 per cent last visited for technical support and a further 13 per cent wanted to make a query about their contract or bill. Other reasons were to browse or buy an accessory (18 per cent) or see or try new technology, such a virtual reality headset or smart home products (10 per cent).

And people listed many reasons that would encourage them back in store, including more models on display, greater availability of stores, shorter queueing times and a more welcoming environment.

“Phone shops will remain a vital channel for the industry, but it’s clear their role is evolving,” Mann added. “Retailers need to find the right balance between selling, supporting customers and showcasing new technology to create some much-needed buzz for the sector. Successful companies will be those best able to integrate their strategy for retail and online selling, offering customers a coherent and complementary experience at every step of the way”.

Trade-In and Refurbished Phones

The survey identifies another rising trend: trading-in a phone when buying a new one. CCS Insight found that 21 per cent of people have sold or part-exchanged a mobile phone directly with a company such as a mobile network operator or a device-maker. This compares with 16 per cent a year ago. Nearly 80 per cent of people said they would be willing to part-exchange their current mobile phone when they come to buy their next one.

Device trade-in is also fuelling a burgeoning market for refurbished mobile phones, which CCS estimates surpassed 3 million units in the UK in 2020. With more than half of people saying they would consider buying a refurbished mobile phone next time they change or upgrade, CCS Insight expects this segment to cement its established position. As belts tighten this year, and people come to rely on connected devices to support home working and home schooling, refurbished phones will be an important trend.

Devices

CCS Insight’s research offered little cheer for suppliers of new phones, with more than a third of people (34 per cent) expecting to own their current mobile phone for longer than their previous one. This is twice the number that thought they will keep it for a shorter period, suggesting that people will continue to replace their mobile phones less and less frequently overall.

In fact, the top reason people gave for buying their current phone is because their old one was damaged or stopped working. The phone market is evolving from routine two-yearly upgrades to one more closely resembling the market for white goods, which are often only changed when they stop working.

But it’s not all pessimism for devices. CCS Insight’s survey showed a big jump in people listing 5G as a reason they bought their current phone. Covid-19 lockdowns may have created new market segments, too: among people who bought their current phone in 2020, 15 per cent said they wanted a better model while confined to their homes, and nearly one in 10 said they had saved money during restrictions and wanted to treat themselves.

Share